The stock market pumped the brakes in October but quickly restarted its engines again. As of Dec. 26, the S&P 500 (SNPINDEX: ^GSPC) has gained 16% in two months, erasing the October swoon and then some. Some would call this a market recovery; others see the technical qualities of a proper bull market.

I’m here to show you a couple of great companies taking this opportunity by the horns. With gains ranging from 24% to 63% since the October trough, the two stocks below are leading this recovery from the driver’s seat.

Making the business world a smaller, simpler place

Let’s start with the milder two-month gain.

Shares of international e-commerce technologist Global-e Online (NASDAQ: GLBE) have gained 24% since Oct. 27. In all fairness, the stock trades at a lofty valuation of 12 times sales and 88 times free cash flow, but I still think it’s a bargain in the long run.

This company holds a unique position in a potentially massive market. Global-e’s services help online retailers run marketing campaigns and sell their goods on a global scale.

A plethora of e-commerce shopping and payment systems provide full integration of its solutions in their own systems. For example, the Global-e integration with Shopify (NYSE: SHOP) gives your Shopify e-store a localized checkout page in multiple countries, supporting payments in the appropriate currency along with the right taxes and duties.

Moreover, Global-e has signed shipping agreements around the world, optimizing the shipping process and fees for every customer.

The idea is to make international e-commerce as simple as an operation right at home. And here’s the best part. Global-e is an order of magnitude larger than its top competitors, ON 24 (NYSE: ONTF) and BigCommerce (NASDAQ: BIGC).

Moreover, companies like ON24 and BigCommerce treat their international shopping as another feature in a broader e-commerce solution. Global-e focuses on its chosen business with laser-like precision.

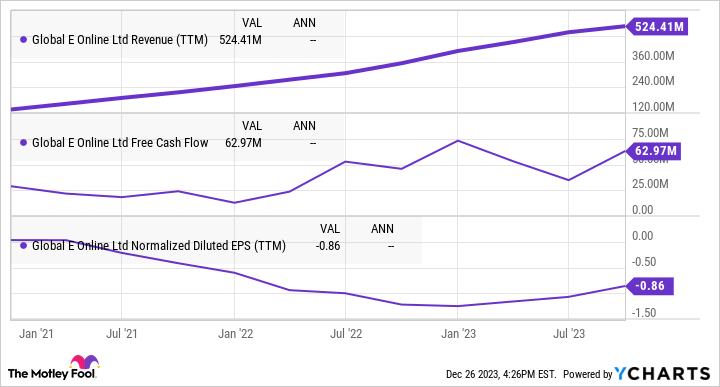

So the stock isn’t cheap, but Global-e’s target market is enormous and largely unexplored. Earnings are negative and free cash flows sit just above the break-even line, but top-line sales are soaring:

That’s growth-stock investing 101. With great risk comes great potential rewards, to misquote Spider-Man’s Uncle Ben.

In this corner of Wall Street, you’ll find outsize growth prospects tied to richly valued and therefore risky stocks. Unexpected events such as regulatory changes or the advent of new rivals can disrupt Global-e and its long-term success, with disastrous results for the pricey stock.

But if you can handle the heat, Global-e looks like a tremendous growth story in the coming decade, as the fragmented e-commerce systems of today feel the urge to work together and globalize the market.

“One app to teach them all”

Next up is language-learning expert Duolingo (NASDAQ: DUOL). The stock has gained 63% in two months, largely thanks to a stellar earnings report.

Your average analyst had expected a net loss of $0.12 per share and a 38% year-over-year revenue jump in the third quarter of 2023.

Duolingo breezed past those targets with ease. The bottom line swung from a loss of $0.46 in the year-ago period to a $0.06 profit per share this time. Sales rose by 43% to land at $138 million. And it was off to the races as Duolingo’s stock closed the next day’s trading 21% higher.

The good news didn’t end with those headline figures. The number of daily active users jumped 63% year over year, and monthly active users posted a 47% gain over the same period. Also, 8% of all Duolingo users subscribed to the premium service in this reporting period, up from 7.4% in the same part of 2022. And bookings rose faster than revenue, indicating stronger demand for subscriptions and ad space in the free-to-use apps.

This green owl is going places, and I can’t wait to see the service evolve. For instance, some users already have access to math and music lessons, presented like new languages in the same learning app.

Other subjects will probably show up over time, especially if the new music and math lessons hit the ground running. And a staggering 80% of Duolingo’s business stems from the U.S. market so far, leaving miles and miles of room to run on a global scale.

Like Global-e, Duolingo runs in pedal-to-the-metal growth mode so far. Every spare penny is reinvested in future growth opportunities, led by sales and marketing alongside research and development. The company isn’t stuffing surplus profits into its own pockets yet. The time for that will come, probably many years down the road when the low-hanging fruit has been picked and it’s time to act like a mature business giant.

For now, Duolingo stock trades at 20 times sales and 89 times free cash flows, roughly comparable to Global-e’s lofty valuation. And it’s another promising growth story that should make today’s $9.8 billion market cap look quaintly small in the long haul.

Should you invest $1,000 in Global-e Online right now?

Before you buy stock in Global-e Online, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Global-e Online wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of December 18, 2023

Anders Bylund has positions in Duolingo. The Motley Fool has positions in and recommends BigCommerce, Duolingo, Global-e Online, ON24, and Shopify. The Motley Fool has a disclosure policy.

2 Ultra-Growth Stocks That Are Leading the Market Recovery was originally published by The Motley Fool